Sports Ownership as Symbol: NBA owners and their non-sports businesses

Today, owning a professional sports team takes money. Lots of money. Billions of dollars. This was not always the case. Owners of NBA teams today are vastly more wealthy than the owners who started a number of teams. Two claims: a. ownership of professional sports teams is a sign that an industry has peaked, b. ownership is increasingly concentrated into a few particularly cash rich sectors. To explore the changes in ownership patterns over time I created a comprehensive list of every season played by a current NBA team, their primary owner, and the non-basketball related industry that person was known for. Inter-rater reliability on this non-basetball industry variable might not be particularly good as they are based on my impressions of the owners primary business. This poses a unique problem over time. For all but the few, richest NBA owners, the appreciation of their team has likely eclipsed their personal fortune. Consider the case of Peter Holt, in the two decades he has owned the Spurs the value of the team has increased ten-fold. The pattern of ownership is charted through a series of network visualizations that when stained backward (from the years to the industries) reveal the change over time from a league run by professional sports managers, truckers, and manufactures, to a league run by financiers and webmasters. |

Eigenvectors suggest that there are really four central industry nodes: Sports Construction Cable Broadcasting Real Estate Car Dealerships Some of these are obvious pairs: construction and real estate are very closely tied, as are cable and broadcasting. Sports demands more of an explanation. The case of Holt is once again instructive. Holt is quite wealthy, but the value of the team and the league as a who could now, save his history as a farm equipment distributor, could be seen as being in the business of sports. For the purposes of this analysis, I limited the use of this cateory to sports promoters, sports venue owners, and perons for whom I was unable to find an obituary that did not say what they did. Now graphics... |

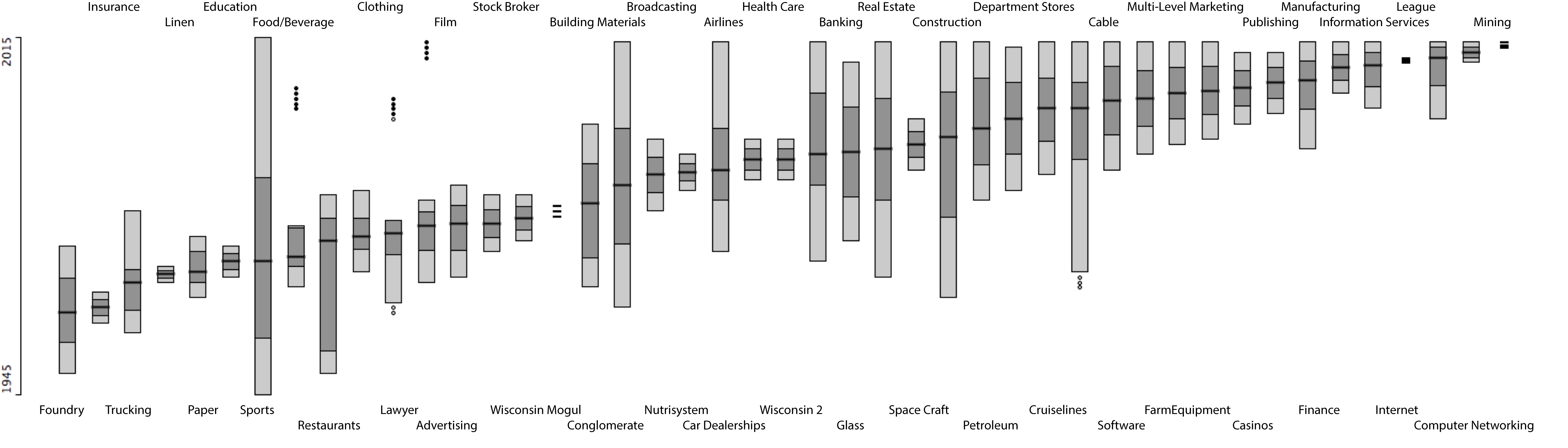

Ownership chage as a paraell box plot.

Box height indicates starting and ending dates, quartiles are marked with shading, ane medians appear as central lines.

Change across the league colored backwards from decades to industries, with a handy gif animating change overtime.

| Overtime |  |

| 1940s and 1950s | |

| 1960s | |

| 1970s | |

| 1980s | |

| 1990s | |

| 2000s | |

| 2010s |

But what does this all mean? The future of NBA ownership is clearly moving down the node family. Many basic manufacturing industries are no longer represented on this chart, and if trends continue, it is clear that finance and internet related fortunes will drive the future of the league.

There is a very real degree to which this distribution is skewed by the presence of deacades of sports industry professionals owning teams in the early days of the league, and this will likely never abate if only for the reason that the barriers to start an NBA team are impossibly high (read: no new teams) and the purchase price of teams will continue to increase.

In the future, the further internationalization of the league will likely bring even greater diversity into the ownership pool mining only entered the list recently with the purcahse of the Nets by a Russian mining tycoon.

A future league controlled almost exclusively by financiers and internet billionaires may be less stable than a league with more diverse owners. A league with a sizable number of addresses on Sand Hill Road and Wall Street is far less stable than one with addresses across the country, especially as both of these ownership pools are in sectors of the economy particualrly subject to bubles. The more depressing idea for society on this front may be that the finance industry in particualr is not supplanting real estate or broadcasting, but that many aspects of those industries may be being absorbed into finanice companies such as Blackstone's rental house project, although these developments may suggest that finance ownership groups will be stable if only because they are involved in so many sectors of the economy.

Other notes:

- Unknown refers to the early days of the Dallas Chapparals. I was unable to find meaningful data on this time period.

- It is clear from reading the stories of these teams that there are many that teams often had early owners who were not suited to owning a team or who did not have enough money. This is a recurring problem. This is true of several current owners.